Find your Pension!

Guest commentary on establishing a European Pension Tracking Service (ETS).

von/by Claudia Wegner-Wahnschaffe, Versorgungsanstalt des Bundes und der Länder/Pension Institution of the Federal Republic and Länder (VBL) – 11/2018

Given the age pyramid and

the issue of pension adequacy in the future, it is becoming increasingly

important for workers to be well-informed about old-age pensions and to have an

overview of their individual pension entitlements. This is a big challenge for

many people, because the topic is complex, and information about pensions often

contains technical terms and is not easy to understand.

The situation is

particularly difficult for mobile workers who have acquired pension rights while

working in different countries. It is difficult enough for these workers to

keep track of their existing entitlements, let alone try to estimate what the

situation will be like in their old age. Researchers are particularly affected

because they often work in temporary employment contracts of less than three years

and then change their research institution.

For many years, the

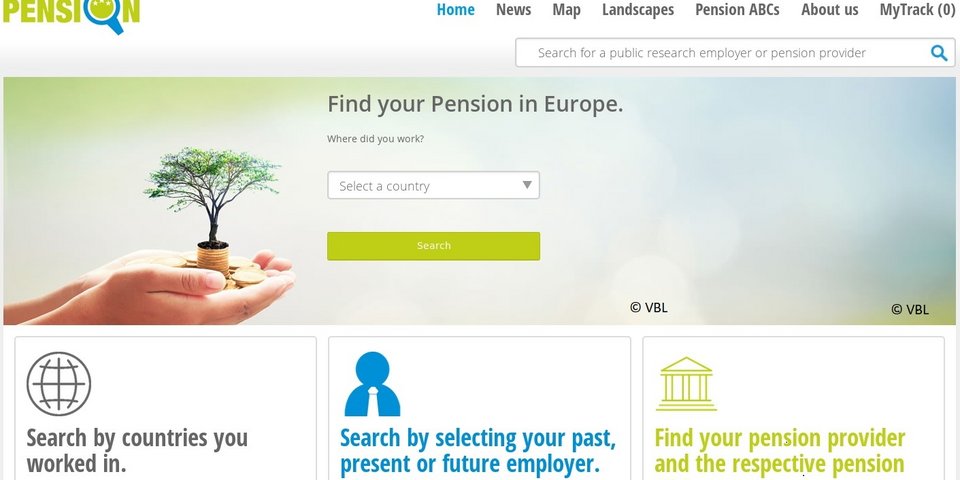

FindyourPension project has offered support to this occupational group with a

wide range of information and the possibility to save their own pension history

on the findyourpension.eu website under ‘MyTrack’. The project is an initiative of the Pension

Institution of the Federal Republic and Länder (VBL) and has been funded since

2011 by the German Federal Ministry of Education and Research with the support

of many pension funds and providers across Europe.

The feedback from mobile

users is consistently positive. Approximately 1,800 researchers have received

training as part of the consultation days regularly conducted at research

institutes by the project team in cooperation with staff from the German Pension

Fund for Miners, Railway Workers and Seafarers. This direct feedback also means

that we have been able to identify room for improvement. As a result, the

FindyourPension website has just been updated and went online with a new look in

October. The interface is now more user-friendly, and the search function has

been expanded so that users can search by country and pension scheme without

first having to enter an employer.

A

target group only has to be selected if this is necessary to classify the responsible

pension institution according to work status of the beneficiary or other user

characteristics. In order to increase awareness and to reach as many other

users as possible, FindyourPension has also been on Twitter since November this

year: https://twitter.com/FindyourPension.

Different user perspectives

The new website also

introduces a user-friendly design that is based on layers. The first basic layer

is aimed at users who have little prior knowledge of old-age pensions and

simply want to get an overview of all relevant information. Users who want more

detailed information can access the second advanced layer via the Pension ABCs

section of the website. These are in FAQ format and are divided into three life

situations. The advanced layer is almost finished and available online. The

basic layer is still being created and will be published on the website in

stages.

FindyourPension Icons

Following the example of

the usual information standards for products, icons are used in the basic layer

to present the contents in a clear and easy-to-understand manner. They make it

possible to find, classify and compare information. The icons only represent

the key questions or information of the pension schemes listed.

For all mobile workers in Europe

In recent years, a

network of over 50 pension scheme providers and institutions has grown. This

cooperation has also resulted in close contact with some national pension tracking

services and the members of the former TTYPE project, which examined and

confirmed the feasibility of a European Pension Tracking Service (ETS). Whenever

we presented the FYP website, we were asked why it was limited to mobile

researchers.

After two years of

intensive collaboration with some of the TTYPE participants and four other

well-known partners, this year we have successfully launched a joint project

proposal as part of the PROGRESS axis of the EU Programme for Employment and

Social Innovation (EaSI), (Call for proposals on social innovation and national

reforms).

Under the proposal, the

results from TTYPE and the current FindyourPension initiative and website will

be used to start constructing an ETS. During the three-year project period, a

pilot will be created and a host organisation will be established. In addition

to the VBL and the European association AEIP, participants in the project

include the Belgian Federal Pensions Service (FPS) and Sigedis, Dutch partners

PGGM and APG (large occupational pension funds), and Swedish partners the

Swedish Pensions Agency and the Swedish tracking service Minpension.se.

To ensure the exchange

of pension information across pillars for mobile workers in Europe, all pension

sources and pillars need to work together. As is well known, beneficiaries make

little or no distinction between the various pillars. They want to know which entitlements

they have already acquired and what they can expect when they retire. For mobile

workers, it would be far easier to get this from one location and not have to

laboriously search for their individual entitlements across countries and

pillars.

Cross-border

identification and authentication of users will gradually become possible over

the next few years via the interoperability of eIDs. At the same time, the

Single Digital Gateway will make it necessary to provide access to individual information

online, including state pension schemes. These developments will also

facilitate tracking and information across pillars for mobile workers as part

of the ETS. This will not only benefit the European pension platform but also

national services and pension providers.

About the VBL

The Pension

Institution of the Federal Republic and Länder (VBL) is the largest supplier of supplementary pensions in Germany. For more

than 85 years, employers in the public service have entrusted the VBL with

managing their employee pension schemes. Currently, the VBL pays out monthly

pensions to around 1.3 million retirees. Around 4.4 million people have

compulsory insurance with VBLklassik. In addition to this standard pension, the

VBL offers a supplementary pension based on VBLklassik, called VBLextra. This allows

members to make their own additional contributions and better secure their

standard of living in old age.