Getty Images - 1933bkk

Getty Images - 1933bkk

Controls are essential

ed* No. 01/2025 – Chapter 5

Controls are needed in addition to good laws to ensure that the law is complied with. In principle, this is a national matter. In Germany, in addition to the labour inspectorate and the employers’ liability insurance associations, the Customs’ Financial Control of Undeclared Work Unit plays a central role in Germany as it is the authority that monitors cross-border work. Its almost 9,000 employees combat undeclared work and illegal employment. 80 per cent of its staff are involved in auditing employers and investigating violations. During their investigations they work closely with the local police, the federal police and the public prosecutor’s office as well as with German Pension Insurance and the tax authorities.

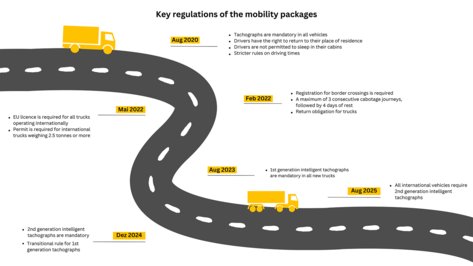

Key regulations of the mobility packages

The German Federal Logistics and Mobility Office is also working in the road haulage and passenger transport sectors to increase safety during road freight transporting, promote environmental protection and ensure market order through inspections and support programmes. Its responsibilities also include monitoring driving times and rest periods, as well as implementing penalty proceedings against foreign drivers.

However, the responsible authorities are often unaware of the contracts or the rules to which the drivers are subject. They are dependent on information from the affected workers, the population and trade unions as well as exchanges with the responsible authorities abroad in order to be able to prosecute and sanction abuses and violations of the law.

The issuing or renewal of the mandatory Community Licence can also be refused in the road haulage sector, in addition to law infringement penalties. Moreover, driver certificates for drivers from third countries can be withdrawn. The Gräfenhausen case had no consequences for the haulage company with regard to this. Apparently, the relevant authority in Poland did not have the will to do anything.

The trade unions have criticised this: they say that there is inadequate monitoring. A study by the Catholic University of Leuven from December 2024 underlines this accusation: there is often a disparity between the political announcements about combating “social dumping” and the low number of controls and inspectors that are needed for enforcing the posting regulations. However, there is also a lack of systematic collecting and reporting of monitoring statistics about enforcing the posting rules, both at European level as well as in most member states. A need to catch up also exists here, so that politicians can be provided with a sound decision-making basis.

Precarious working conditions also exist in the construction sector

The construction sector, which employs around 13 million people throughout the EU, is subject to fierce competitive pressure, resulting in harsh conditions. In this sector, too, companies throughout Europe are often dependent on skilled labour from abroad. Almost one in three construction workers in Germany come from Eastern Europe. Only one in ten is a posted worker with a foreign employment contract. Third-country nationals are increasingly being hired. A network of non-transparent and ever-lengthening subcontractor chains is responsible for the poor working conditions. The statutory minimum wage and labour laws are often circumvented. This is because not only the general contractor and all the subcontractors want to earn something. The longer the chain, the less money is available to the company that ultimately carries out the work.

The most dangerous workplace in the world

During 2022, 22.9 per cent of all fatal workplace accidents in the EU occurred in the construction sector. 1 One year later, there were almost 97,000 workplace accidents at German construction sites, with 76 of these resulting in fatalities. 35 of the dead workers came from abroad.2

Proof of social insurance: The A1 certificate

EU rules on the coordination of social security determine which national social security system applies in the event of temporary cross-border activities. If the social security system of the country of origin applies, then this must be documented through an A1 certificate. This must be applied for beforehand and carried along during the work posting. If an employee is unable to produce the A1 certificate, then they might have to be insured in the country of employment and pay contributions there. The A1 certificate is not to be confused with the posting notification required under labour law but is often referred to as such colloquially.