©Getty Images/iStockphoto

©Getty Images/iStockphoto

Cross-border cooperation in monitoring contributions, also with non-EU states?

ed* No. 03/2018 – Chapter 6

Several participants in the study agreed that attempts to obtain revenue data from platform operators about the transactions they have brokered are now doomed to failure if the operator is based in a non-EU European country or even outside Europe.

Coordinated steps at European level to overcome this bottleneck are still pending. So far, there has only been a vague idea to use the European Platform tackling undeclared work, within the proposed European Labour Authority, as a knowledge centre for undeclared work done via platforms. The proposal of labour market expert Enzo Weber to establish a Digital Social Security Account under the umbrella of an international organisation also needs to be developed further. Under his proposal, platform operators would have to transfer a certain proportion of turnover generated by platform workers. A potential starting point would be to work at OECD level to promote the international exchange of tax-relevant data in the digital labour market. The next step could be to think about making these new structures useful for social security purposes.

Is there a need for action?

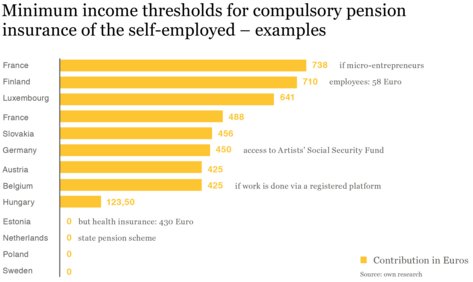

It is true that responses from policy makers to the phenomenon of platform work have been rather unsystematic and experimental. As the ESIP study has shown, there are only a few isolated cases where fresh approaches have been put in place to deal with rules specifically tailored to platform work and social security. These range from including platform workers in the social security systems (special rules specifically for platform work), continue with special minimum income thresholds (e.g. Belgium), a special basis of assessment and contribution rate (France), and new forms of monitoring and paying contributions, and go all the way through to automatically reporting income data (Belgium, Estonia, France), albeit on a mainly voluntary basis. Whether these approaches are worthwhile is yet to be seen. Nevertheless, they are a step in the right direction in terms of collecting and monitoring contributions.

There is also some doubt whether completely new legal approaches to the phenomenon of platform work and social security really are needed. Often it is enough just to be consistent with implementing rules for self-employed workers, as long as these rules exist. Germany is not the only country where action needs to be taken with regard to the social protection of self-employed workers.

However, the ESIP study makes it clear that the existing systems have proven to be adaptable, either by applying existing rules to platform workers or through customised solutions. Gaps in access to social protection, which European institutions have rightly highlighted as a problem, are often not the result of new forms of work but rather due to the phenomenon of marginal or low-paid employment. Issues related to platform work are more likely to be issues related to tracking undeclared income. It remains to be seen whether European solutions will help here or whether international efforts are needed instead.

The study is not published yet but can be requested if there is any interest.