iStockphoto / olaser

iStockphoto / olaser

Demographic trends

ed* Nr. 02/2021 – Chapter 3

The 2021 Ageing Report predicts that Europe’s population will have shrunk by five per cent by 2070 and that its structure will change. The proportion of the working age population (20 - 64 years) will decrease from 265 to 217 million people. This means a 15.5 per cent decrease in the labour supply despite the expected increase in the labour force participation rate.

At the same time, life expectancy will increase by 7.4 years for men and 6.1 years for women, both of which would lead to a given convergence. The so-called “age dependency ratio” is projected to increase by almost 25 percentage points over the projected period. This rate describes the ratio of the over-65-olds to the working-age population. In plain English, this means: that today1 there are about three people of active age for every person over 65 and in 2070 there will only be two. However, the age composition of the pension cohorts will also change. Currently, four out of ten pensioners are older than 75. By 2070, there will be six.

Expenditure developments at a glance

These demographic assumptions, together with a number of others that cannot be discussed here, are the basis for the “principles” or “reference scenario” of the “AWG”2 (Ageing Working Group of the Council’s Economic Policy Committee). This scenario is also relevant with regard to fiscal monitoring by the Member States.

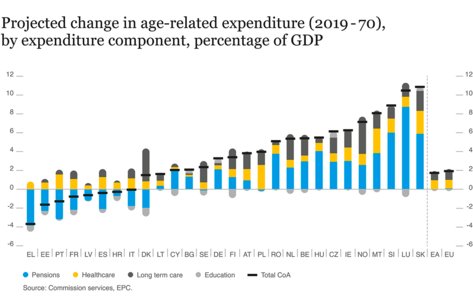

Based on this scenario, the Ageing Report projects an overall increase in age-related costs from today’s 24 per cent of Gross Domestic Product (GDP) to 25.9 per cent across all of the expenditure areas. However, there will be considerable differences between Member States in this respect. Germany is among the 15 countries where the increase is most significant.

An itemised breakdown of the increase is revealing. “Main drivers” of the increase in the Member States as a whole will be the expenditure on health (+ 0.9 percentage points) and long-term care (+ 1.1 percentage points), whilst the contribution from pension costs, after a temporary increase, will fall back to the level of the year in which it started. By contrast, spending on education and training is expected to fall slightly.

However, the composition of the “cost drivers” is somewhat different here in Germany. Pensions will account for the lion’s share (2.1 percentage points), whereas health and long-term care costs will only increase by 0.4 and 0.2 percentage points respectively.